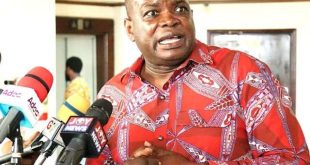

Tomorrow, July 25, 2025, the Mid-Year Budget Review will be presented to Parliament by Finance Minister Ken Ofori-Atta, a source from the Finance Ministry has revealed to Joy Business.

It does so at a time when the economy has begun to recover from the turmoil it went through in 2022.

The data from the Bank of Ghana’s July 2023 Summary of Economic and Financial Data suggest a notable improvement in the nation’s economic fundamentals. Many people think that the International Monetary Fund Program serves as a gesture of appreciation for helping to stabilize the economy in some small way.

While the rapid rise in inflation has been slowed, the cedi has stabilized against the dollar and other important foreign currencies. Additionally, lending rates have been dropping.

Again, according to data from the Bank of Ghana, Ghana had a trade surplus of $1.77 billion in the first half of 2023.

The strategies to bolster economic stability and foster growth are set to take center stage in the mid-year budget review.

The review of the budget comes after Ghana’s public debt rose by a fifth in just four months, in part due to the inclusion of short-term loans from the central bank to the government.

According to information posted on the Bank of Ghana’s website, the total public debt, excluding debt owed by state-owned firms, increased to GH569.3 billion ($49.7 billion) at the end of April.

The amount was changed to reflect the government overdraft provided by the central bank, which was securitized in December 2022.

According to the central bank’s review of economic and financial data, the debt amount as of December increased from an earlier estimate of 434.6 billion cedis to 473.2 billion cedis following the adjustment.

Obligations as a percentage of GDP decreased from 77.5% in December to 71.1% in April.

Ghana, which missed a payment on a Eurobond earlier this year, is restructuring the majority of its debt as part of a $3 billion IMF program that was approved in May in order to make it sustainable.

In February, the nation finished the first phase of a domestic debt exchange. Investors exchanged 87.8 billion cedis in liabilities for new securities that paid as little as 8.35% instead of the old notes’ average interest rate of 19%.

As of July 14, domestic dollar bonds and cocoa bills totaling $1.5 billion underwent reorganization, resulting in lower coupons for investors.

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More