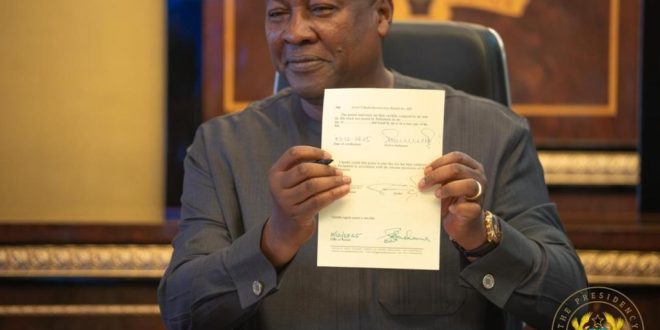

The COVID-19 Health Recovery Levy Repeal Act, 2025 has been officially signed into law by President John Dramani Mahama, thereby removing the one percent tax on products, services, and imports during the peak of the COVID-19 epidemic.

On Wednesday, December 10, the President signed the repeal, paving the path for the full elimination of the levy starting in January 2026.

As part of the government’s initiative to do away with what it has called “nuisance taxes” and lower living expenses for people and businesses, Parliament approved the repeal last month.

As part of Ghana’s pandemic recovery efforts, the COVID-19 Health Recovery Levy was first implemented in 2021 under the COVID-19 Health Recovery Levy Act (Act 1068), which was signed into law on March 31, 2021.

As part of the government’s initiative to do away with what it has called “nuisance taxes” and lower living expenses for people and businesses, Parliament approved the repeal last month.

As part of Ghana’s pandemic recovery efforts, the COVID-19 Health Recovery Levy was first implemented in 2021 under the COVID-19 Health Recovery Levy Act (Act 1068), which was signed into law on March 31, 2021.

The charge was intended to help the government finance COVID-19 expenses, rebuild fiscal buffers, and restore health systems.

The Act levied a 1% tax on imports and the value of taxable products and services in Ghana, with the exception of those that are exempt from VAT laws.

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More