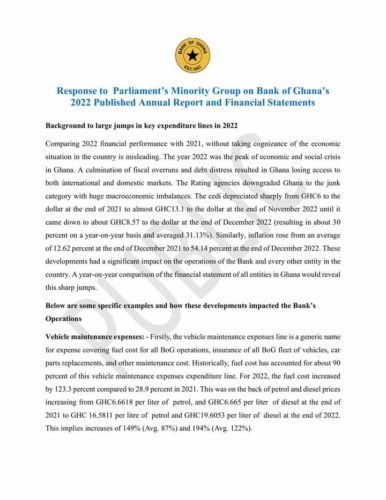

The “sharp jump” in operational costs has been attributed by the Bank of Ghana (BoG) primarily to the “sharp” depreciation of the Cedi versus the Dollar and the increase in inflation in the 2022 fiscal year.

The Bank said that the two factors had an influence on its operating needs, including those for vehicle maintenance, communication, international and domestic travel, and spending for External Directors.

The BoG stated that inflation and exchange rate changes in 2022 had a significant impact on the operations of the Bank and every other entity in the country in response to several allegations of poor management made by the Minority in Parliament.

According to the Central Bank, 2022 marked the height of Ghana’s economic and social crisis, and it is inaccurate to compare 2022’s financial performance to 2021’s without taking the nation’s economic position into account.

The BoG provided an explanation of what caused the increase in its vehicle maintenance costs.

: “For 2022, the fuel cost increased by 123.3 per cent compared to 28.9 per cent in 2021. This was on the back of petrol and diesel prices increasing from GHC6.6618 per litre of petrol, and GHC6.665 per litre of diesel at the end of 2021 to GHC 16.5811 per litre of petrol and GHC19.6053 per litre of diesel at the end of 2022. This implies increases of 149 per cent (Avg. 87 per cent) and 194per cent (Avg. 122 per cent).”

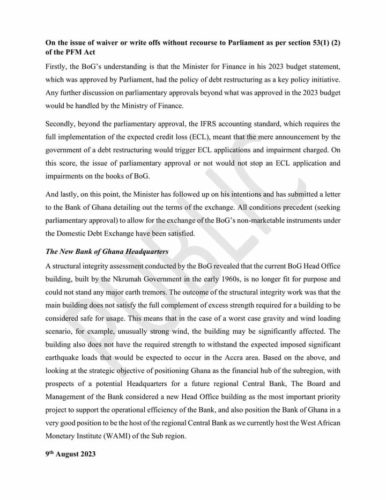

Regarding waivers or write-offs without consulting Parliament, the BoG stated that the Minister of Finance included debt restructuring as a major policy priority in his 2023 budget statement, which was approved by Parliament.

The Ministry of Finance would be in charge of handling any future discussions on parliamentary permissions beyond those included in the 2023 budget, according to the Central Bank.

“Secondly, beyond the parliamentary approval, the IFRS accounting standard, which requires the full implementation of the Expected Credit Loss (ECL), meant that the mere announcement by the government of a debt restructuring would trigger ECL applications and impairment charged. On this score, the issue of parliamentary approval or not would not stop an ECL application and impairments on the books of BoG,” it said.

Read the full statement below:

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More