In the 2024 budget, the Ghana Union of Traders Association (GUTA) has demanded that the Special Import Levy and the Covid-19 Levy be abolished.

A low cost of doing business will boost production and allow the government to collect more of the targeted revenue, according to GUTA President Dr. Joseph Obeng.

The government implemented the Covid-19 Health Recovery charge in 2021 as a stand-alone charge that was applied to the gross value of taxable deliveries of goods and services that were rendered through the VAT Flat Rate Scheme and Standard Rate Scheme.

However, appeals have been made for the government to discontinue the one percent tax following the World Health Organization’s declaration that Covid-19 is no longer a public health emergency.

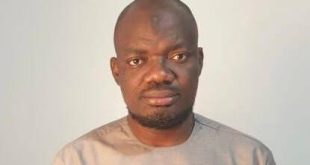

“We are talking about the 1.0% COVID-19 levy to be removed. We also talk about the special import levy of 2% that has been imposed on us since the previous administration. We also are talking about the VAT [Value Added Tax], the complex nature of VAT,” Mr Obeng stated.

In November 2023, the Finance Ministry will present the 2024 budget to Parliament. Interest groups, including GUTA, have contacted Finance Minister Ken Ofori-Atta before of his presentation.

Numerous groups have voiced worries regarding the high tax rates in the nation, according to the Finance Minister, who also stated that their issues will be taken into consideration prior to the presentation.

Despite the Finance Ministry’s pledges that some taxes will be eliminated, the COVID-19 charge and the special import charge in particular must be removed, according to GUTA.

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More