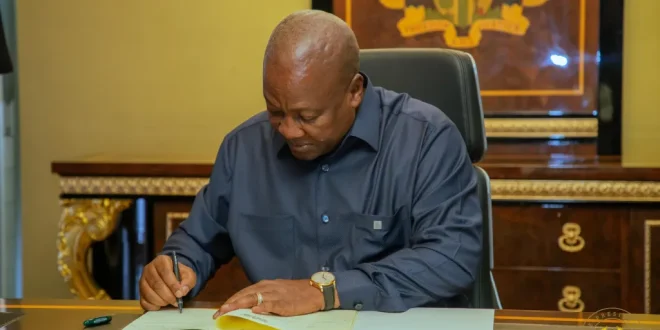

A number of important tax and fiscal reform bills that are intended to help Ghanaians financially, boost economic growth, and improve state financial management have been formally signed into law by President John Dramani Mahama.

The controversial Electronic Transfer Levy (E-Levy) has been repealed, and important tax and revenue management rules have been amended.

According to the National Democratic Congress’s (NDC) agenda, the action aims to lower living expenses, promote corporate growth, and provide a more equitable tax structure. On Wednesday, March 26, 2025, Parliament approved the repeal legislation, opening the door for President Mahama to sign them into law.

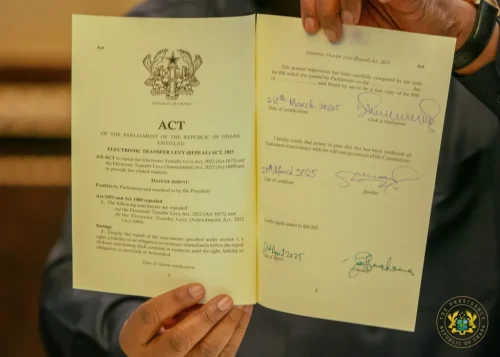

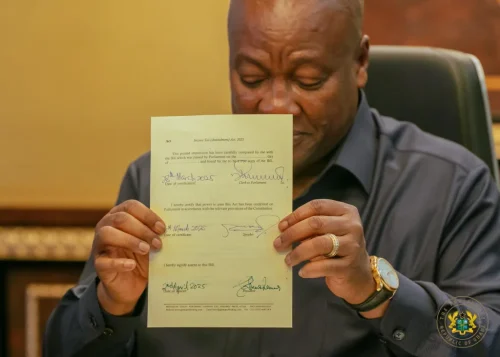

The following bills have now been officially signed into law:

- Electronic Transfer Levy (Repeal) Bill, 2025

- Betting Tax Repeal

- Emissions Levy (Repeal) Bill, 2025

- Earmarked Funds Capping and Realignment (Amendment) Bill, 2025

- Public Financial Management (Amendment) Bill, 2025

- Public Procurement (Amendment) Bill, 2025

- Value Added Tax (Amendment) Bill, 2025 (VAT on Insurance)

- Petroleum Revenue Management (Amendment) Bill, 2025

Finance Minister Dr. Cassiel Ato Forson introduced eight bills to Parliament on March 13, 2025, with the goal of repealing and amending a number of taxes and levies. These bills were the Earmarked Funds Capping and Realignment (Amendment) Bill, 2025, the Electronic Transfer Levy (Repeal) Bill, 2025, the Emissions Levy (Repeal) Bill, 2025, and the Income Tax (Amendment) Bill, 2025.

A 1% fee was applied to all electronic transactions, including online purchases and mobile money transfers, when the E-Levy was first implemented in 2022. Because of the apparent impact on discretionary earnings, there was strong public opposition to its adoption. Stakeholders in the gaming business also criticized the Betting Tax, which imposed a 10% tax on gross winnings from gambling activities.

President Mahama’s administration hopes to enhance public financial management, encourage corporate growth, and lessen the tax burden on citizens with these policies. The government anticipates that these policies will stimulate investment, increase consumer spending, and propel economic growth in a number of industries.

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More