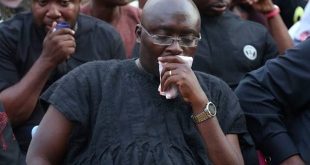

Prof. Stephen Adei, an economist and former board chair of the Ghana Revenue Authority (GRA), is fighting the recently implemented VAT on domestic electricity use.

He is adamant that it will worsen consumer conditions and reduce businesses’ ability to compete.

His remarks follow a government order for the GRA to coordinate with the Northern Electricity Distribution Company (NEDCO) and the Electricity Company of Ghana (ECG) in order to transfer Value Added Tax (VAT) collected from domestic customers who use more electricity than they need to survive, starting on January 1, 2024.

Prof. Adei responded to the government’s directive on Upfront on the Joy News channel, saying that it would harm the already fragile economy of the nation.

“There’s no doubt at all people will be worse off. You’ll first focus on things that increase production and then that in turn will feed into your taxes. You should be going after the billions of uncollected property taxes and people getting away [inaudible], being exempted, not even the more important ones.

“The mines have millions of exemptions and these are the ones we should go after rather than going after the ordinary producer and consumer when it comes to electricity.”

The 15% Value Added Tax (VAT) for residential customers of electricity over the maximum consumption level specified for block charges for lifeline units has started to be implemented, according to the Ministry of Finance.

According to the Ministry, this complies with the First Schedule (9) of the Value Added Tax (VAT) Act, 2013 (ACT 870), as well as Sections 35 and 37.

It became operative on January 1, 2024.

According to the Ministry, this is a component of the execution of the government’s Medium-Term Revenue Strategy and the Post-Covid-19 Programme for Economic Growth (PC-PEG), which is supported by the International Monetary Fund (IMF).

For the avoidance of doubt, in accordance with Sections 35 and 37 and the First Schedule (9) of Act 870, VAT is still exempt for “a supply to a dwelling of electricity up to a maximum consumption level specified for block charges for lifeline units,” according to a statement released by the Ministry.

Read the statement below:

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More