MTN Ghana has held its 4th Annual General Meeting considering that list at the Ghana Stock Exchange in 2018. The assembly noticed the approval of the Audited Financial Statements for the year ended thirty first December 2021 and the statement of a very last dividend.

After reading the entire year overall performance of the agency in 2021, the entire dividend for the year became 11.5 pesewas in step with proportion, representing 70.6% of income after tax and a 43.8% growth in dividend in step with proportion payout in 2021 over 2020.

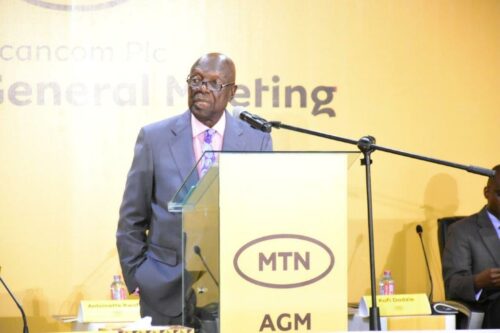

Board Chairman of MTN Ghana, Dr. Ishmael Yamson, attributed the massive increase withinside the agency’s sales to sturdy increase in Data Service, Mobile Money, and Voice Service. During the period, the agency recorded 56.3% increase in statistics sales, 38.2% increase in Mobile Money sales supported via way of means of a few 4.9% increase in voice sales.

He careworn that the beyond year ended effectively and confident shareholders that MTN Ghana will constantly enterprise to ensure the agency is well-controlled with great pursuits of shareholders in mind.

“We had a successful Annual General Meeting. The results were very good. Shareholders approved the payment of very decent dividends. We assure shareholders that our focus is a very robust governance culture that will ensure that the company is well managed, well catered for and continues to operate in an ethical manner,” Dr. Yamson indicated.

Speaking at the event, Chief Executive Officer of MTN Ghana, Selorm Adadevoh, explained that during the period in review, 4G network coverage was improved to over 90 per cent with an addition of 1,446 sites to reach an extra 1.7 million people. Additionally, the company added on 131 2G sites, 130 3G sites, while some 1,200 sites were modernized to improve customer experience.

Mr. Adadevoh expressed optimism for the 2022 financial year stating that the company forecasts revenue growth in the high teens. “We forecast service revenue growth in the high teens (in percentage terms) over the medium-term from the previous guidance of 13% to 15%. In addition, we will progress the execution of the expense efficiency programme and our prudent approach to managing costs to deliver on our commitment of margin expansion,” he said.

Scancom PLC (MTN Ghana) held its first AGM in May 2019 after it listed on the Ghana Stock Exchange (GSE) on 5 September 2018. It remains the company with the largest number of Ghanaian shareholders following its Initial Public Offering (IPO) which raised GHS 1,146,589,464.75 from 128,152 applicants. The IPO of MTN Ghana made history as the largest primary share offer in the history of the GSE. Most importantly, it enabled many Ghanaians to own shares in one of Ghana’s largest, most visible and well-respected companies.

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More