The scheduled implementation of the 15 percent Value Added Tax (VAT) on residential electricity consumption has been officially suspended by the government.

Therefore, the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO) have been directed by the Ministry of Finance to cease enforcing the tax.

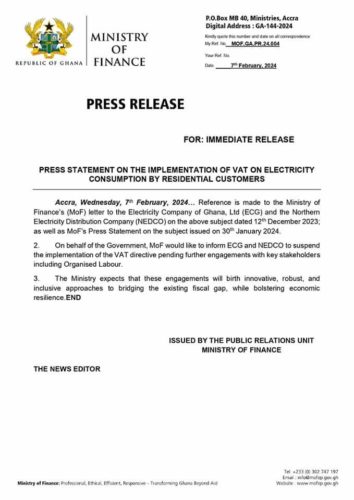

On Wednesday, February 7, 2024, the Ministry of Finance released a press release containing this data.

Given the serious concerns expressed about the impact on businesses and consumers, the Ministry argues that the suspension is required to allow for a thorough discussion and to gain the support of labor unions and industry participants.

“On behalf of the government, the Ministry would like to inform ECG and NEDCO to suspend the implementation of the VAT directive pending further engagements with key stakeholders including organized labour”, the statement read.

Beginning on January 1, 2024, electricity users who exceed the maximum amount permitted for block charges for lifeline units will be subject to a tax policy, per an order from the government. The purpose of this action was to assist the country’s Medium-Term Revenue Strategy and the Post-COVID-19 Program for Economic Growth (PC-PEG), an IMF-backed initiative aimed at raising capital.

Nonetheless, this was fiercely opposed by a number of interest groups, who saw it as a punitive and ill-thought-out policy.

According to earlier reports, the government was considering scheduling a meeting with the IMF to discuss the estimated revenue shortfall required to halt the power VAT.

“The Ministry expects that these engagements will birth innovative, robust, and inclusive approaches to bridging the existing fiscal gap, while bolstering economic resilience”, the statement added.

Read the full statement below:

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More