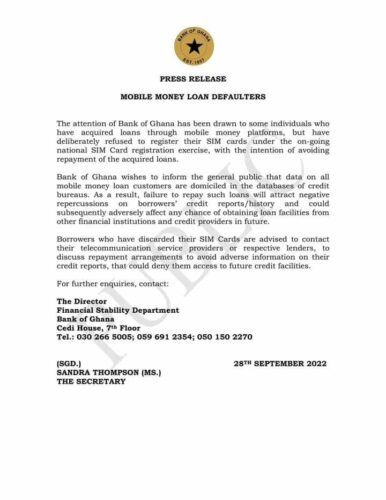

The Bank of Ghana has provided advice to those who have obtained loans using mobile money platforms but have consciously chosen not to register their SIM cards as part of the ongoing national SIM Card registration drive in an effort to avoid making loan repayments.

In a statement, the Central Bank stated that all mobile money loan customers’ data is kept in credit bureau databases.

The Bank of Ghana (BoG) asserts that people who have consciously chosen not to repay loans obtained from their service providers will experience adverse effects on their credit histories and reports.

According to information that has come to light, some people who obtained loans through mobile money platforms have declined to register their SIM cards in an effort to avoid paying back the debts.

Others have done the same thing purchased new SIM cards, registered them, and disposed of the old ones all with the goal of delaying repayment of the loans they had taken out.

The Bank of Ghana desires to inform the public that information on all consumers of mobile money loans is stored in the databases of credit bureaus.

Failure to pay back such loans will have a detrimental effect on the borrower’s credit reports and history, which may therefore make it more difficult for them to get loans from other financial institutions and credit providers in the future.

Read the BoG statement below:

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More