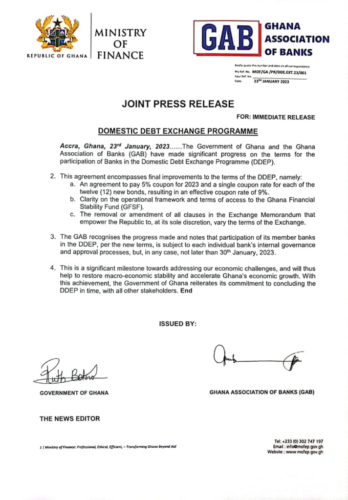

The terms of banks’ involvement in the Domestic Debt Exchange Program(DDEP) have seen major advancements between the Ghanaian government and the Ghana Association of Banks (GAB).

Final adjustments to the program’s conditions are included in the revised agreement.

These include a commitment to pay a 5% coupon in 2023 and a single coupon rate for each of the twelve (12) new bonds, resulting in an effective coupon rate of 9%, clarity regarding the operational structure and conditions of access to the Ghana Financial Stability Fund (GFSF), and the removal or modification of all provisions in the Exchange Memorandum that permit the Republic to change the terms of the Exchange at its sole discretion.

A joint statement from the Finance Ministry and GAB that was released on Monday contains this information.

According to the revised rules, the Association of Banks stated that each bank’s internal governance and approval procedures must be followed before a member bank may participate.

GAB stated that member banks’ participation in any issue should not come beyond the January 30 deadline.

“This is a significant milestone towards addressing our economic challenges, and will thus help to restore macro-economic stability and accelerate Ghana’s economic growth. With this achievement, the Government of Ghana reiterates its commitment to concluding the DDEP in time with all other stakeholders,” the statement stated.

Read the full statement below:

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More