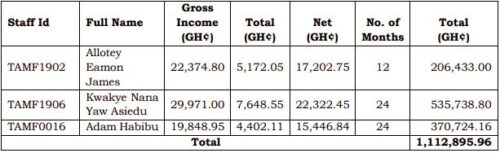

The Ministry of Finance (MoF) paid three individuals a total of GH1,112,895.96 in salary from January 2020 to December 2021 despite the fact that they were not employees of the Ministry, according to the Auditor General.

A Principal Spending Officer of a covered entity is required to ensure that only the names of employees who are eligible to receive payment for work performed are kept on the payment voucher and to maintain records of the nominal roll of the covered entity in a way that ensures the proper amount of emolument is paid, according to Regulation 86 of the Public Financial Management Regulations, 2019 (L.I. 2378).

However, the Auditor General highlighted in his audit report for 2021 that he was unable to locate the personal files and names of the three individuals who received wages for a year while listed on the Ministry’s nominal roll.

Here are the specifics:

The Chief Director and the Ministry’s payroll validators should be held liable for the sum of GH1,112,895.96, according to the A-recommendation. G’s

Observations made by the Auditor General regarding the Ministry of Finance are summarized in the following passages:

Failure to withhold taxes – GH¢70,103.00

When paying a service fee or insurance premium with a source in the country to a non-resident, Section 116 of the Income Tax Act, 2015 (Act 896) as amended requires a resident person, other than an individual, to withhold tax on the gross amount of the payment at the rate specified in the First Schedule if the amount involved exceeds two thousand currency points.

Additionally, Section 117 stipulates that a withholding agent who fails to make a tax deduction must pay the tax that ought to have been deducted.

We saw that although Bloomberg Finance LP, a non-resident, received approval and payment from the Treasury and Debt Management office for service fees for using their terminals and buyout fees, GH70,102.68 in taxes were not withheld from those payments.

We advised the Chief Director to see to it that the Ghana Revenue Authority receives payment of GH70,102.68 from the Ministry of Finance (MoF) (GRA).

Garnishee Orders on Ministry of Finance Bank Accounts

We noticed that in July 2021, a court ordered the Ministry of Finance’s Sub Consolidated Fund and Chief Director’s Bank Accounts to be frozen.

We also saw that three further Ministry accounts—Special Fiscal Programmes & Payments, Investor Relations Payments, and Ghana Cares Accounts—were also garnished in March 2022, preventing the Ministry from using the five accounts for any transactions.

Our investigation revealed that four MDAs were the targets of judgments acquired by Sweater & Sock Factory Ltd, D.K. Owusu & 85 Others, Togbe Anku Woade, and Chude Mba. The abovementioned accounts were then garnished by the courts to cover the judgment obligations.

According to the Ministry of Finance (MoF), the majority of Garnishee Orders were brought about by other MDAs who failed to make payments for the goods and services they received as well as judgment debts that resulted from lawsuits that were launched against them.

The MoF further stated that frequently, the Ministry was not made aware of the court proceedings and subsequent Garnishee Orders in order for its Legal Unit to be able to present itself in court.

We suggested that the origin of the Garnishee Orders be looked into, and if someone is found to be at fault, the proper punishments be implemented.

Additionally, we suggested that the Ministry of Finance consult with the Minister for Justice and the Office of the Attorney General regarding the best course of action with regard to the garnishee orders.

Unrecovered loans and advances – GH¢11,005,582.00

The Principal Spending Officer of a covered entity shall take effective and necessary actions to collect money owed to the covered entity, according to Regulation 32 of the Public Financial Management Regulations, 2019 (L.I. 2378), among other things.

We observed that despite the MoF providing loans and advances to civil and public workers, there is no control system in place to ensure that these loans and advances are recovered.

Our analysis of Loans and Advances managed by the Controller and Accountant General’s Department from January 2010 to December 2021 revealed that deductions exceeded the one-year and five-year time limits for loans and advances, respectively.

Advances and loans that were as old as four years, eight months and eleven years, respectively, had not yet been entirely repaid.

We suggested that the Chief Director work with the Controller & Accountant General’s Department to ensure that the overdue sum of GH11,005,581.89 be immediately deducted from the affected individuals’ wages.

Uncompetitive procurement According to Section 18 of the Public Procurement Act, 2016 (Act 914) each stage of the procurement activity and the prescribed procedures must be carried out in accordance with the Public Procurement Act’s provisions.We saw that Management selected 15 service providers for accommodations with conference facilities totaling GH2,318,823.29 by hand, without following any established procurement procedures.

Additionally, the transactions were not included in the Ministry’s procurement strategy for the fiscal year 2021.

Source: Ghanatodayonline.com

Ghanatodayonline.com News, Politics, Health, Education & More

Ghanatodayonline.com News, Politics, Health, Education & More